QMS Can Help You Reduce Your Insurance Costs

June 21, 2024

QMS Can Help You Reduce Your Insurance Costs

In today’s uncertain business climate, most companies are looking for ways to minimize costs while maximizing efficiency and quality. It’s a well-established fact that a robust Quality Management System (QMS) offers an excellent return on investment. QMS increases brand equity, reduces returns, improves operational efficiency, and saves on waste, scrap, and rework.

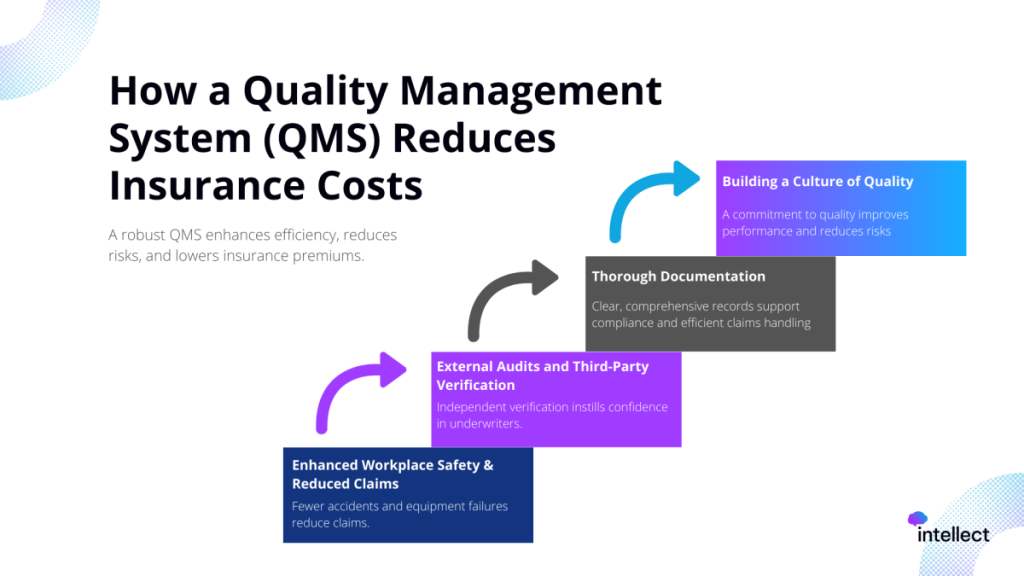

But companies that invest in QMS also benefit from reduced risks in other areas as well, including fewer workplace accidents, lower incidence of equipment failure, improved training and awareness among employees, and more. Clear standards and processes, along with mechanisms to incentivize compliance, help to ensure successful outcomes and reduced risk, which in turn can lead to lower insurance premiums.

The Value of Quality Management Systems

Quality management systems help companies structure their goals and activities around a commitment to high standards, continuous improvement, risk management. QMS instills discipline into company culture, improving performance across the board. This commitment is often recognized by underwriters and risk managers, who are willing to offer reduced premiums to companies that excel in quality management.

Intellect has joined forces with Assured Partners to offer a free guide that explains how robust QMS systems and practices can lead to lower insurance costs. Let’s look briefly at some of the specific ways in which QMS can help reduce insurance premiums:

1. Enhanced Workplace Safety & Reduced Claims

Effective QMS systems and practices enable companies to proactively reduce workplace accidents and equipment failures. By standardizing operating procedures, they can limit variability and reduce the risk of errors. Quality management systems ensure that employees are adequately trained and that their competency is routinely assessed and renewed. A sound QMS integrates risk management, encouraging everyone in the organization to identify, assess, and control risks systematically. This proactive approach leads to fewer accidents and insurance claims, demonstrating to insurers that the company is a lower risk, which can result in lower premiums.

2. External Audits and Third-Party Verification

External audits offer independent verification that a company holds its people to clear standards of accountability, which instills additional confidence among underwriters. ISO 9001 certification, for instance, is a global standard that includes an emphasis on proactive risk management. Organizations that adhere to such standards will improve both the quality and safety of their operations. Independent audits verify compliance with these standards, further reducing risk and potentially leading to lower insurance costs.

3. Thorough Documentation

A robust QMS requires thorough documentation of processes, incidents, and corrective actions. This transparency reassures insurers about the organization’s commitment to quality and risk management. Comprehensive documentation supports compliance with regulations and standards, lowers the risk of regulatory action and lawsuits, and improves the efficiency of handling claims, if and when they do occur. Efficient management of claims can lead to fewer payouts and lower premiums over time.

Building a Culture of Quality

The story of the GM/Toyota partnership, known as NUMMI, is a powerful example of how embracing quality management can transform an organization. Before the partnership, GM’s Fremont plant was plagued with poor quality, low productivity, and abysmal labor relations. In the early 1980s, Toyota’s approach to quality management transformed the plant’s culture, leading to significant improvements in efficiency and product quality. This transformation resulted in the NUMMI facility performing on par with Toyota’s Japanese factories within just two years.

Quality pioneers at companies like Toyota, Ford, and 3M recognized that QMS processes are essential for achieving excellence in all aspects of operations. By nurturing a culture of quality, these organizations improved their products and services, increased customer satisfaction, and saved money. A culture of quality fosters deeper engagement and high performance, contributing to a company’s overall success.

Implementing a Robust QMS

To achieve the benefits of a strong QMS, business leaders should invest in flexible, highly configurable QMS solutions that can adapt to their changing needs. For example, Intellect’s QMS solution offers ultimate flexibility, allowing non-technical users to configure the software to meet their unique requirements. This adaptability ensures that the QMS workflows fit the way the company operates, enhancing efficiency and manageability.

Quality management systems are a smart investment for any organization looking to improve performance and reduce costs. By providing a structured framework for excellence, QMS helps companies streamline processes, reduce waste, and proactively manage risks. This leads to improved compliance, increased operational efficiency, and potential savings on insurance premiums.

Companies that can demonstrate a commitment to minimizing risks through effective QMS practices are better positioned to negotiate lower insurance premiums. As such, a robust QMS is not only a tool for ensuring quality but also a strategic advantage for managing costs and driving long-term success.

Want to learn more about reducing insurance premiums with a robust, configurable QMS? Download our free guide, How a QMS can Lower Insurance Premiums, courtesy of Intellect and Assured Partners.